Payment Processors in Canada: No One Else Specialise In Hospitality Industry Like We Do.

We offer the most advanced payment authentication solutions available in Canada. Our services are designed to reduce your processing risk as well as be able to leverage the lower costs now being made available by MasterCard and Visa Card brands. Hence, creating a Point-of-Sales Payment environment that will provide the best value along with an optimised cost structure, among all other payment processors in Canada.

At National Payments, we hold payment security as our priority. That’s why we make a proactive effort to help provide our merchants everything they need to keep their business protected. From achieving PCI DSS compliance accreditation to securing your customers’ data throughout transactions. Thus, our clients love us for the support we provide, among all other payment processors in Canada.

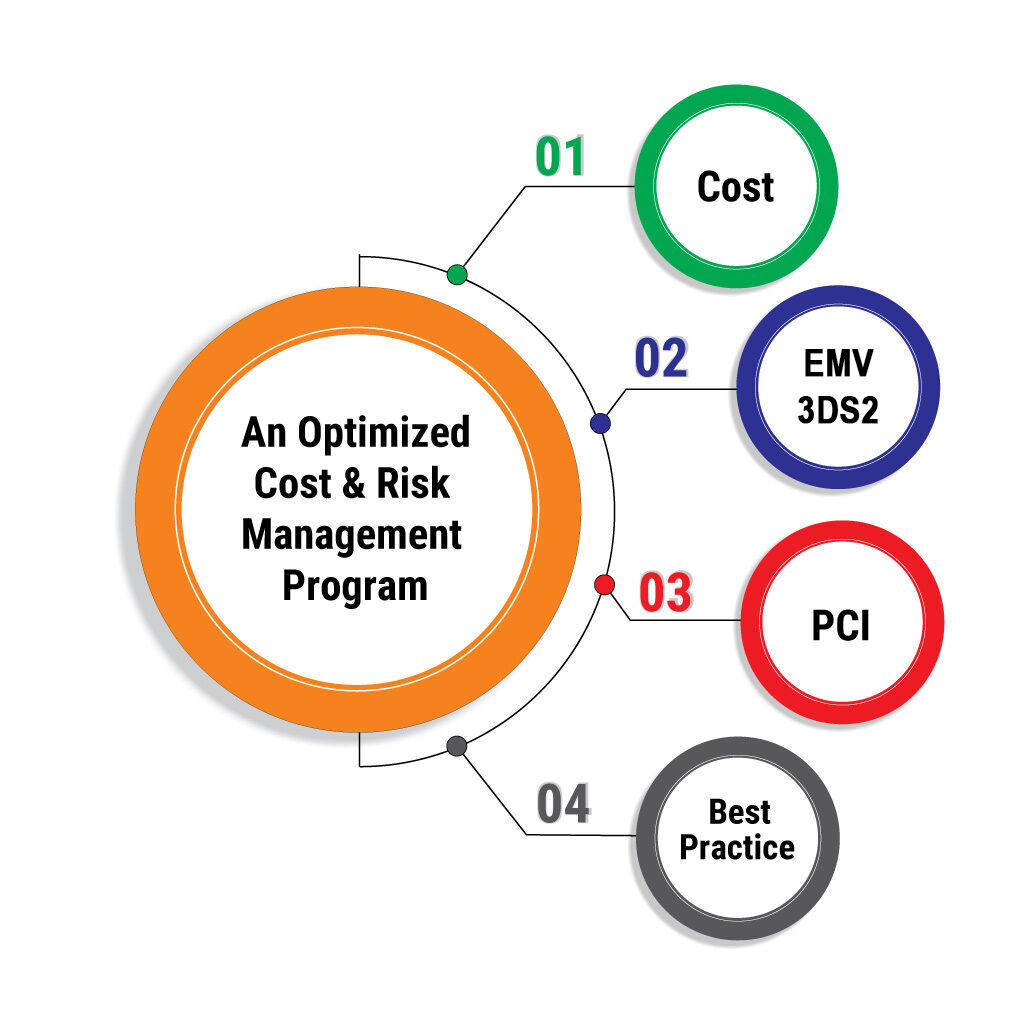

COST & RISK MANAGEMENT

In today’s credit card processing environment in North America, National Payments firmly believe that we are in a uniquely qualified position to best provide hotels an optimised cost & risk management program. Not to mention, we help hotels manage their risk better than any other payment processors in Canada.

Specialised Payment Processors in Canada

National Payments is the only payment processor in Canada that specialises in hotels as well as hospitality industry. No one else has the expertise in handling hotel payments like we do.

PREVENT FRAUD

Those existing hotel properties that are still processing credit cards via mag-swipe are at serious risk of card data being compromised, plus the additional costs associated with chargeback’s that cant be disputed due to fraudulent credit card transactions and or non-EMV processing.

National Payments help provide your business the best in industry practices and recommendations to significantly reduce costly chargebacks from your profit center, thus improving your bottom line.

It’s this approach that has lead to a proven and excellent track record with our merchants for chargeback reduction and prevention. Moreover, we have refined our experience in chargeback prevention and best practices. Also, our innovative templates better assist your business with refuting chargebacks and improving your bottom line.

Each merchant is a truly valued client of ours, and we work hard to earn your trust and confidence through superior customer service and proactive tool kits on a day-to-day basis.

Proudly, no one else in the industry can match our commitment for chargeback prevention guidance.