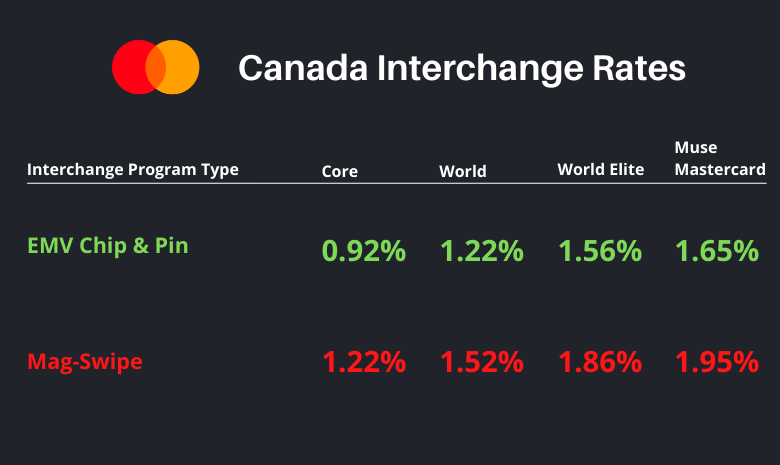

If your still processing credit cards on your PMS by magnetic swipe, you are paying up to 0.30% more on every MasterCard transaction then you need to be paying.

Moreover, Visa Canada will be introducing a new surcharge for non EMV transactions to take effect October 2021.

Here are the official rates from Mastercard for mag-swipe vs. Chip & Pin users.

Did you know that the average Chargeback due to fraudulent credit card presentment at a Canadian hotel is valued at over $600?

Those hotels that are still processing via mag -swipe (non-EMV Chip & Pin manner) have:

- Zero protection against fraudulent claimed chargebacks

- Can expect to lose thousands $$$ in unnecessary losses each year

Did you know that the impact of chargeback losses due to credit card fraud can increase your overall credit card processing costs by up to 0.10% over what you are paying today.

If a Canadian merchant processes a Canadian Visa or Mastercard equipped with chip functionality in a “Non-EMV Chip & Pin” manner, the merchant is 100% responsible if the credit card turns out to be fraudulent.

Why continue taking the risk?

Let National Payments help you migrate to EMV chip & Pin